The Reserve Bank of India has issued instructions allowing travellers arriving from G20 countries to make payments in India via the mobile-based Unified Payments Interface (UPI).

This move is intended to provide foreign nationals visiting the country with a convenient and secure payment option.

UPI: A Single Mobile Application for Banking Services

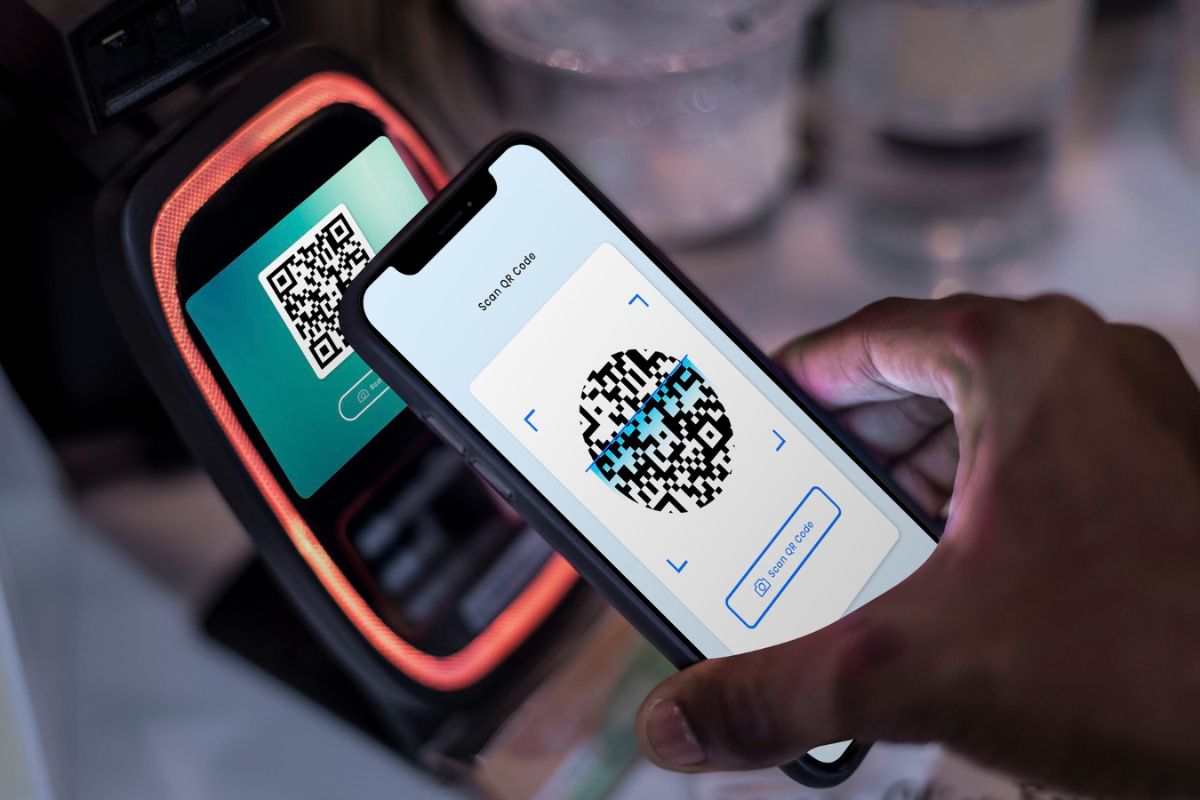

UPI is a system that combines multiple bank accounts into a single mobile application, providing a variety of banking services such as seamless fund routing, merchant payments, and more on a single platform.

Access to UPI for Foreign Nationals and NRIs

The RBI announced on Wednesday that foreign nationals and NRIs visiting India would be able to use UPI. The service would initially be available to G20 travellers arriving at select international airports, with plans to expand it to other entry points in the country.

Eligibility for UPI Access

The Reserve Bank of India (RBI) has announced that G-20 travellers will initially have access to the Unified Payments Interface (UPI) at select international airports. This service will eventually be available to foreign nationals and NRIs at all entry points throughout the country.

Argentina, Australia, Brazil, Canada, China, the EU, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom, and the United States comprise the G-20.

Prepaid Payment Instruments for INR-Denominated Full-KYC PPIs

The RBI circular stated that banks and non-banks would be permitted to issue full-KYC PPIs in INR to foreign nationals and NRIs visiting India.

These PPIs would be distributed in the form of wallets linked to UPI and would be limited to merchant payments. After physical verification of the customer’s passport and visa, the PPIs would be issued.

Immediate Effect and Loading/Reloading of PPIs

The RBI’s instructions are now in effect, and PPIs will be loaded or reloaded against receipt of foreign exchange, either in cash or through any payment instrument. Unused balances in PPIs can be cashed out in foreign currency or returned to the source.

Bottomline

This move by the Reserve Bank of India is a step forward in promoting digital payments and providing convenience to foreign nationals visiting the country. The UPI platform offers a secure and efficient payment option, making it easier for travellers to manage their transactions while in India.

Follow and connect with us on Facebook, Twitter, LinkedIn, Instagram and Google News for the latest travel news and updates!