In a significant move, the Central Government of India has announced the waiver of 20% Tax Collection at Source (TCS) on transactions made through International Credit and Debit Cards.

This decision comes in response to concerns raised by taxpayers regarding the imposition of TCS on such transactions under the Liberalised Remittance Scheme (LRS) starting from July 1.

The Finance Ministry has clarified that no TCS will be collected on small transactions up to Rs 7 lakh, providing relief to taxpayers.

Procedural Clarity Ensured

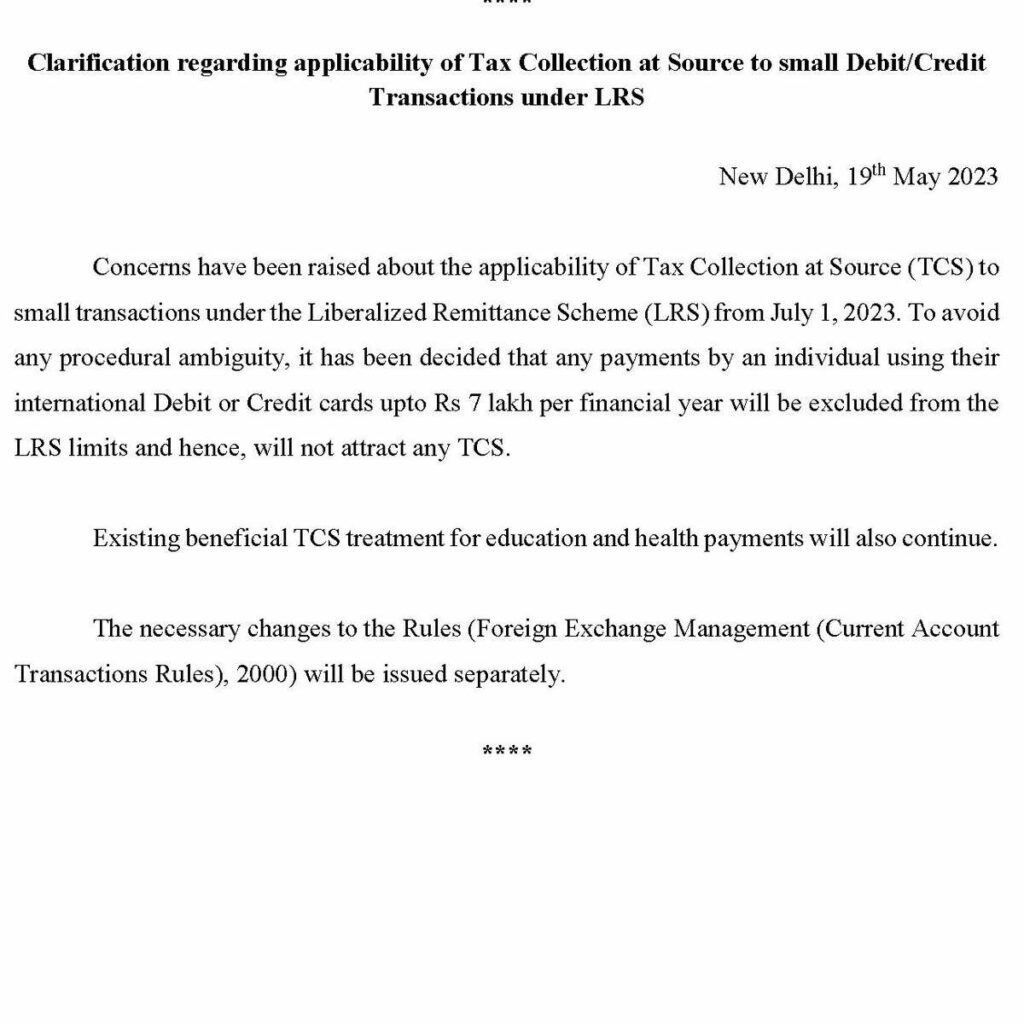

To address the concerns raised by taxpayers, the Government of India issued a circular clarifying the applicability of Tax Collection at Source (TCS) to small transactions under the Liberalised Remittance Scheme (LRS).

The circular stated that in order to eliminate any procedural ambiguity, individuals making payments using their international Debit or Credit cards up to Rs 7 lakh per financial year will be excluded from the LRS limits. Consequently, these transactions will not attract any TCS.

Continuation of Existing TCS Benefits

In addition to the exemption for small transactions, the circular also confirmed that the existing beneficial treatment of TCS for education and health-related payments will continue. This ensures that individuals making such payments under the Liberalised Remittance Scheme (LRS) will still receive the established tax benefits and exemptions.

Amendments to Rules to Be Issued Separately

To implement these changes seamlessly, the necessary amendments to the Foreign Exchange Management (Current Account Transactions Rules), 2000 will be issued separately.

These amendments will provide explicit clarity on the exclusion of small debit and credit card transactions from the purview of TCS under the Liberalised Remittance Scheme (LRS).

A Boost for International Transactions

The decision to waive off TCS on small transactions under the Liberalised Remittance Scheme (LRS) showcases the government’s commitment to creating a favourable environment for individuals engaging in international financial activities.

This exemption enables individuals to conduct small transactions abroad without being burdened by the applicability of TCS, thus streamlining the process and encouraging international economic interactions.

Upcoming Official Notification

The government will soon release an official notification containing detailed amendments to the existing rules. This notification aims to ensure that individuals and financial institutions are well-informed about the revised regulations, enabling them to comply effectively with the updated guidelines.

With this latest development, taxpayers can now carry out international transactions using their credit and debit cards with the reassurance that no TCS will be levied on transactions up to Rs 7 lakh.

Follow and connect with us on Facebook, Twitter, LinkedIn, Instagram and Google News for the latest travel news and updates!